We are all inundated by car insurance TV ads offering the cheapest insurance on the market. Paying more than you have to doesn’t make sense, but don’t fall for the lowest quote if you want to really protect your house and assets.

Liability Coverage

Unlike buying toilet paper or lettuce you have a lot on the line by clicking internet boxes for the cheapest coverage.

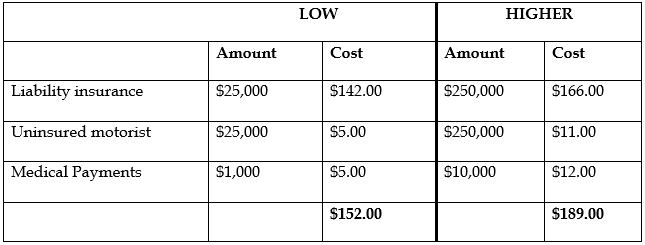

For instance, the first quote you get on the Progressive website is for liability insurance to cover you if you are sued for being the cause of an accident. Most states require drivers to carry minimum amounts of car insurance. New Hampshire law requires a minimum of $25,000 to be covered if you buy car insurance here ($20,000 in Massachusetts). To protect yourself and your assets, there is a lot more to consider than meeting New Hampshire’s minimum insurance requirement because more insurance may be needed if there’s an accident with serious injuries or property damage. If you injure someone and they are out of work for six months with $72,000 in medical bills you are on the hook above that $25,000 cheapo insurance.

Uninsured Coverage

But what if it is the other way around? You are hit by a driver with no insurance or assets so you now have to make that claim against your own insurer (let’s say Progressive), but what if you have only $25,000 for that uninsured driver who put you in the hospital for ten days? Is $25,000 going to make you whole for medical bills, lost pay and pain and suffering? Of course not.

The internet price difference as of September 20, 2020, for a 2013 Dodge Durango driven by me was $5.00 for that $25,000 of insurance. Not being an idiot I want to protect my family so I could get $250,000 of hit-and-run type coverage for only $6.00 more or $11.00. Would you want ten times the protection for only $6.00 more for a half year quote?

Medical Payments

Finally, the third half year quote you can click on is called Medical Payments coverage. This pays out of pocket medical and prescription expenses, co-pay reimbursement, etc. It even will write you a check for bills your health insurer already paid! Again, the cheapo amount is $1,000 of coverage for $5.00. Yet if you clicked on the box for $10,000 of this coverage, it only costs $12.00. Once again, for peanuts you protect your checkbook from expenses someone else caused you to occur when they t-boned you.

Comparison Chart

Bottom Line

The example from Progressive shows that you can’t beat the $152.00 for six months quote. But if you aren’t an unemployed 19 year old, for just $37.00 more you get ten times the protection. Don’t hurt you or your family by lowballing car insurance.

Douglas, Leonard & Garvey, P.C. has handled hundreds upon hundreds of motor vehicle accidents and we have seen firsthand how the cheapest coverage has hurt our clients. Don’t just shop price but protect your family and your assets.

And by the way, while I clicked through the Progressive site, I would never use them as we end up suing them more often than any other insurer for screwing their own customers when it is time to settle a case.